Supply, Demand and the Exaggerated Demise of Oil

In This Issue:

- JP Morgan analyst: policies are reducing fossil fuel energy capacity faster than demand can switch to renewables

- Oil supply must rise to balance steady demand

- EVs face challenges from infrastructure and copper supply

In response to reports of his passing in 1897, the great American author, Mark Twain, was alleged to have told a reporter that “The reports of my death are greatly exaggerated.” Today, the same might be said of the oil industry. A year after the COVID-19 pandemic began, there have been some surprises that have caught the markets by surprise. One of those surprises is likely how fast and furious the rise in oil prices has been. An oil price rally this rapid has only happened three times in the last 20 years. Many oil companies were caught off guard with the rate of ascent of oil prices. In fact, 53 US oil companies have lost $3.2 billion in the first quarter of this year as they locked in selling prices of no more than $50 per barrel – while the actual price they could have received was between $60 and $65 per barrel.

Prior to the COVID-19 pandemic and especially in the immediate aftermath of the global economic lockdown, the consensus narrative was hardening around the idea that the world had seen peak oil demand as the push was on towards renewable fuels. Most apparent in this push is the focus and commitment of the auto industry towards bringing electric vehicles (EVs) to market.

The onset of the global pandemic began to strengthen the consensus opinion that oil was in a permanent decline as oil consumption fell sharply. Last year, the US gasoline market (the largest in the world) reduced oil consumption by almost 2.3 million barrels per day.

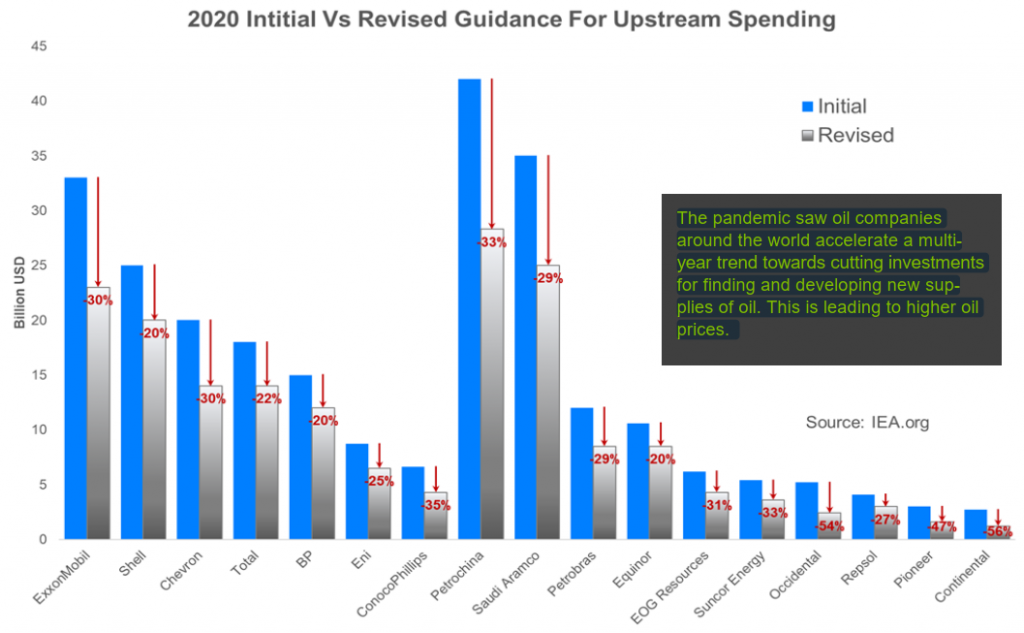

Supply Destruction

While the demand side of the equation was often talked about, what was missing from the outlook for the oil industry’s future were discussions around supply. Specifically, the multi-year trend amongst oil producing nations that saw investment aimed at finding new oil supplies continue to fall. Data from the International Energy Agency (IEA) shows that spending by global companies has fallen from $1.18 trillion in 2014 to only $500 billion in 2020 (a 60% decline). It should be noted that the decline was steady and in place prior to the COVID-19 pandemic (see chart page 2). According to the IEA, reduced investment in bringing new supplies to market risks a reduction in global oil production of 9 million barrels per day by 2025.

US Oil Production Falling

For over a decade, US oil production has been the largest source of new supply to the global oil markets — accounting for over 20% of global production. US oil production rose from 8.1 million barrels per day to 13 million barrels per day over the four-year period ending May 2020. Since then, US oil production has dropped to 11 million barrels per day with the most optimistic expectations being that US production will rise to about 11.8 million barrels per day later this year.

Recent industry surveys by the Federal Reserve Board of Dallas show that the energy industry in the US expects that there will continue to be a supply gap that will persist over the next two to four years. Though US producers have begun to increase their drilling activity, they are hesitant to spend more on growing oil production because shareholders are demanding more cash be returned to them in the form of dividends. Management at these companies believes that shareholders will penalize their stock by sending it lower if they focus on growing production.

Pressure to Not Invest Is Global

Data from the BP Statistical Review shows that from 2010 to 2020, global oil production has only risen by 0.60% per year. To be fair, this is skewed significantly lower by the freefall in oil production last year in response to the COVID-19 pandemic and a collapse in production in Venezuela. If 2020 is excluded, global oil production from 2010 to 2019 only rose by 1.47% per year. It is important to note that during this nine-year period, the growth in US production was 9%. Said another way, if it was not for the US oil industry’s tremendous growth, global production would be much lower and oil prices would be higher.

Traditionally, the OPEC nations were the swing producers that would swoop in to balance oil markets so that oil prices did not rise too fast in a short time period. But today, OPEC is focused on getting maximum profits from its reserves as these nations realize that the future of energy consumption will not be as centered on oil as it has been in the past. In addition, analysts cite the fact that many OPEC member nations cannot raise production as they do not have the infrastructure capacity to do so.

Russia, the world’s third largest oil producer, has also been cooperating with OPEC. In the past, Russia would undercut OPEC efforts at price stability by raising its production to steal some of the customers for OPEC oil. But like OPEC, its production of oil is impacted by the fact that most of its oilfields are extremely old and the geological formations of its reserves do not allow production to be raised significantly. Russian cooperation has led to OPEC being referred to as “OPEC Plus.”

Pressure From the IEA to Raise Production

The IEA stated in May of this year that if the goal of “net zero” greenhouse emissions was to be met by 2050, there were 400 IEA milestones that had to be met which included “… net zero emissions in the electricity sector by 2040, no new sales of vehicles with internal combustion engines by 2035, and building the equivalent of ‘the world’s current largest solar park’ roughly every day.” The IEA also stated that there should be no new investments in fossil fuel supply projects.

But only a month later, the IEA did an abrupt U-turn and is asking OPEC and Russia to increase their oil production as soon as possible. Suddenly worried about a rebounding world economy and oil’s skyrocketing demand with it, the IEA last week said “OPEC Plus needs to open the taps to keep the world oil markets adequately supplied.” The IEA is now arguing that OPEC and Russia could boost oil production by two million barrels a day (mb/d), while “if sanctions on Iran are lifted, an additional 1.4 mb/d could be brought to market in relatively short order.”

Rise of the Electric Vehicle

There are an estimated 1.4 billion cars on the world’s roads today. According to data from the Global EV Outlook 2021, the global electric car fleet reached 10.8 million units – an increase of 41% (3.2 million units) over the 2019 levels. This is impressive from the perspective that total global auto sales fell in 2020. But the trend of EV sales shows that there is a long way to go before EVs are able to cut into internal combustion engine and gasoline sales. About 44% of the 2020 EV sales came from Europe. In the all-important US auto market, electric vehicles sales rose 4% while the overall market saw sales fall 15% in 2020. US EV sales were dominated by the Tesla Model-Y. In Canada, sales of EVs fell 7%. Looking forward, 2021 global sales estimates for EVs are expected to be 4.6 million units while global automobile (cars and SUVs) sales are expected to be almost 83.5 million units for 2021.

Governments Are All-In on EVs

Governments in North American and Europe have made it clear that they view the opportunity to “build back better” from the COVID-19 lockdown will involve an emphasis on decarbonization. Auto manufacturers have announced a commitment to bring on dozens of new EV models with General Motors saying it will stop selling gasoline powered cars and light trucks by 2035. Government support in terms of tax credits have been helpful but going forward, if electric cars are to make more substantial inroads, several challenges will have to be overcome. One such challenge involves whether national power grids will be able to provide the electricity that is going to be required.

In a recent study by the non-profit Rocky Mountain Institute, it was found that if every American switched to an electric vehicle, US electricity consumption would rise by 25%. This would require the construction of many new power plants and an upgrade to the energy transmission grid. The study found that the challenges are being underestimated. For consumers, this will mean that electricity rates would have to rise substantially but they would no longer have gasoline expenditures.

While the challenges of the grid can be solved with technology, additional investment and regulatory changes will have to be undertaken. For the EV trend to accelerate towards the optimistic projections, it is estimated that trillions in additional investment will be required globally.

Copper Supply Pivotal to Decarbonization

Copper will play a central role in the decarbonization of the world. Both EVs and windmills use an enormous amount of copper. EVs use three times more copper than internal combustion engine vehicles. EVs can use over a mile of copper wiring per vehicle as it is used to connect the battery to all electronics. Depending upon the vehicle, the Copper Development Association states that the internal combustion engine uses 18-49 lbs of copper (depending on the vehicle) while hybrid electric vehicles (HEV) use about 85 lbs and plug-in hybrid electric vehicles use 132 lbs. Battery electric vehicles use about 183 lbs.

Not only do EVs require more copper, the infrastructure that will be required will use even more copper. The Copper Development Association states that there are about 5.5 tons of copper used for each megawatt of renewable power. Charging stations and new charging installations in the home will require increased use of copper.

However, recent data from Bank of America shows that copper inventories are at a 15-year low while industry experts believe that 1996 marked the highpoint for new copper discoveries. While copper can be recycled repeatedly, Bank of America believes that the world risks “running out of copper” due to the gap between supply and demand.

For users of copper and ultimately consumers of EVs, the news is not good. Traditionally, scrap copper supply is able to make up supply shortfalls as high prices induce the practice of scrapping existing copper through recycling and other measures. But for only the third time in history, the scrap copper market is seeing a supply deficit.

Copper and Oil Are Going To Be Linked

Like oil, copper supplies are seeing the effects of underinvestment and the fact that new copper deposits mineable at economic rates of return are increasingly hard to find. When deposits are found, new mines can take years to start up.

Global oil consumption is expected to be back to an all-time high by the end of the year – barring any unexpected turns with respect to the COVID-19 variants.

About 60% of global oil consumption is used for transportation while 40% is used for plastics, lubricants, and other uses. Despite the various hurdles to a purely EV future for transportation, EVs will replace some future oil demand.

Despite governments wanting to get to net zero emissions, the world’s population will rise from 7.8 billion to 9 billion people over the next 20 years. Most of this growth will be constrained to the emerging or developing nations. India has stated recently that its need for development cannot be put behind the goals of decarbonization.

The path to decarbonization has begun but remains uncertain given the constraints and challenges ahead. But for the foreseeable future, oil will still play a key role in the world’s energy needs.