Tactical Fund

The Pacifica Partners’ Tactical Balanced Fund has been designed to provide a similar investment management expertise that we deliver to our segregated clients but in a pooled-fund format.

The Tactical Balanced fund seeks to achieve a balance between capital appreciation and capital preservation.

The fund’s monthly performance can be found on Globe-Investor by clicking here.

In order to accomplish its mandate, the fund invests in equities and bonds, as well as select alternative assets. A key focus of the fund is to over time manage the down-side volatility of the fund’s performance by employing a dynamic asset mix and sector rotation strategy.

Who is this fund for?

The fund is ideal for investors that are looking for a unique and sophisticated investment vehicle that is “non-indexed” yet provides diversified exposure to core asset classes and sectors while also managing downside risk. This fund is intended to be the core holding of a Canadian balanced investor’s portfolio.

Investment Holdings

The Tactical Balanced Fund seeks to achieve its objective by investing in a diversified portfolio of equity and fixed income holdings. At times, the fund may also hold relatively smaller positions of options, futures, and other alternative investments.

The Fund’s equity holdings consist of mainly large market capitalization companies, with a bias towards dividend growth stocks. Regional exposure of the fund’s holdings are primarily focused on Canada and the US, and supplemented with investments in select International and multi-national companies.

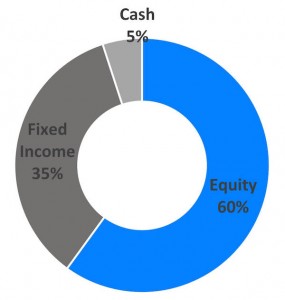

Benchmark Asset Mix

The fund is best classified as a: “Balanced Fund with a Tactical Asset Allocation overlay” and dynamically shifts between asset classes for the purposes of risk reduction. At times where we believe that market volatility is or will occur, we will reduce equity exposure, or shift to stocks and bonds in more defensive sectors.

Asset mix and sector rotation decisions are primarily based off of a “Top-Down” investment approach that utilizes macroeconomic and broad market factors. Individual security selection is based on a “Bottom-Up” approach that involves examining the specific attributes of each individual company.

Investment decisions are biased towards a value investing style, with other strategies, including momentum, growth, and special opportunity strategies employed to avoid an excessive concentration on only a few investment characteristics. To learn more about Pacifica Partners’ investment strategy please contact us.

Additional Fund Details

Manager: Pacifica Partners Inc.

Auditor: KPMG LLP

Counsel: Borden Ladner Gervais LLP

Custodian: National Bank Independent Network

Administrator: Commonwealth Fund Services

Units of the fund are valued monthly.

Historical fund performance, current sector allocations, and current fund holdings are available for clients of Pacifica Partners. Please speak to a Pacifica Partners advisor for more detail.