Vancouver’s Housing Bubble Fueled by China’s Credit Bubble

Many of us are under the impression that there is an endless supply of multi-millionaires in China who are intent on scooping up Vancouver properties at any price, often before they even hit the market. But the underlying source of the money does indeed have a limit, and we might be getting close to that limit. There is an unprecedented $25 Trillion (USD) credit bubble in China that will deflate at some point, and the big question is when.

Once a credit contraction happens, it will not matter whether buyers are coming in with cash or taking out local credit – not only will new buying activity slow dramatically, there will likely be margin calls on the net worth of existing foreign investors. This could lead to forced selling. Without the steady inflow of new capital, it is not difficult to predict what will happen to real estate prices here.

This poses an extreme risk to the financial well-being of locals who have recently taken out large mortgages, as well as to the broader BC economy.

Vancouver housing prices have far exceeded anything that resembles market fundamentals, and numerous reports have foreign buyers as a prime factor, with the majority from mainland China. Prices for detached homes are up some 30% year over year and the average detached price went as high as $1.8 Million this year.

There is no doubt that there is a continuing debt binge of over-mortgaging by locals, thanks to easy lending and record low interest rates. However, the foreign-money factor is legitimate and a key driver of demand for multi-million dollar properties, which has a trickle-down effect into the rest of the lower mainland and elsewhere in the province. The rise we’ve seen in prices has less to do with population growth, municipal planning and our restricted geography (though all are factors) than it has to do with global credit expansion. Without credit, there’s no money to buy houses, even by those who seemingly buy with “cash”.

The average Vancouver detached home is priced at over 20 times the average pre-tax household income. Consider that a “normal” house price-to-household income ratio should be in the range of 4-6 times income. According to RBC, the average household needs 110% of pretax income just to take a mortgage out on the average Vancouver home.

So will prices rise indefinitely? Will a 40-year old Vancouver Special be going for $4 Million in 10 years? The answer is no. Prices only go up so long as credit expands. And 800 years of financial history tells us that credit bubbles are normal and are really just a part of human behavior, and they all end the same way, with a recession. With the sheer size of China’s credit bubble, its collapse would certainly cause a credit contraction in Canada along with a global recession.

China’s credit bubble in context

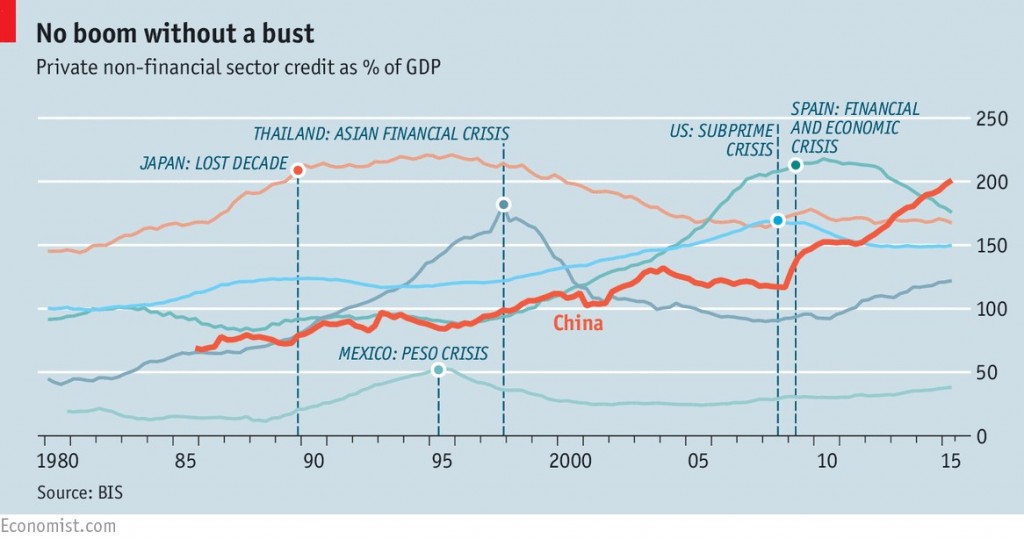

China looks to be in the late stages of extraordinary credit bubble, one which is comparable to the Japanese bubble of the 1980s or the US sub-prime debt bubble of 2007-08. The chart below (Figure 1) illustrates this comparison, showing the total credit-to-GDP levels in each of the three countries (source: Bank of International Settlements, credit to Economist.com and Asian Nikkei Review). China’s rise in total credit has been much sharper, which makes sense given our recent low interest rate environment.

Deutsche Bank researchers also recently noted that bank credit growth in China today has surpassed bank credit growth in the USA at the height of its subprime lending bubble.

Figure 1: Comparing Recent Credit Bubbles (source Bank of International Settlements, via the Economist)

In only 15 years, China’s outstanding credit has grown from roughly $1 Trillion to $25 Trillion (USD). China has used the growth in credit to overproduce infrastructure such as roads, airports and even malls and housing stock to such an extent that it is estimated that they have as many as 70 million residential units (condos) sitting empty. According to one widely cited report from the Washington Post, China used more cement in three years, from 2011-2013, than the United States used for all of its construction during the entire 20th century (100 years!).

In addition to overbuilding at home, there’s been an exodus of capital as Chinese companies and individuals have been purchasing land, businesses, buildings and property throughout the world – not just in Vancouver or Toronto. This June, CNBC reported that Chinese investors have bought over $300 Billion (USD) of property in the USA in the last 5 years with a third of that coming just last year.

Chinese investors are worried that China’s economy and currency may be living on borrowed time and they are increasingly desperate to move their capital out of China and into foreign assets and currencies. In addition, there is a crackdown on corruption that the Chinese leadership has undertaken – increasing the desperation to move money out of the country.

How do we know that China debt is a bubble?

We know it’s a bubble because 1) the scale is unparalleled and huge relative to China’s GDP (Gross Domestic Product); 2) it is unsustainable because the effectiveness of credit growth is declining (see chart below) and because of the oversupply of unused goods and infrastructure; and 3) financial engineering is occurring on a growing scale.

For example, the Bank of China is buying the defaulting loans for an equity stake in the companies who have borrowed too much. This creates “zombie” companies, which are businesses which cannot pay back their loans but are not allowed to go bankrupt and die. The state has even instructed six of its larger domestic banks to issue asset-backed securities with the defaulting loans as the underlying assets (for more see this recent Bloomberg article). Repapering bad debt with asset-backed securities draws obvious parallels with the Sub-Prime Mortgage Crisis of 2008. The Bank of China itself wrote in their 2016Q2 Outlook: “Commercial banks face a grim operating situation, implying more difficulties for coordinative implementation of monetary policy”.

The Financial Times noted that it now takes four times the amount of credit to create GDP growth as it did 10 years ago, meaning that it’s getting close to the point where new credit growth is like “pushing on a string” in terms of effectiveness to create economic productivity. From prior credit bubbles, we know that once credit growth stops creating real economic results, credit often will contract.

Andy Xie, a former economist for the World Bank, Morgan Stanley and contributor to the South China Morning Post, was bullish on his home country during the past decade. Recently, he reversed his stance, and was quoted in Marketwatch stating that rampant speculation in China will end in a market crash and a “1929-style Depression.”

When will it burst?

Though fundamentals suggest that China’s debt bubble is showing signs of weakness, it really is impossible to provide an accurate timeline because of the nature of China’s economy. With centralized decision-making by the government, reliable data is difficult to come by. It is quite possible that their government might push credit to $30 Trillion and force state-owned enterprises to continue the bad lending to banks and business for a long-time to come.

If we do see credit continue to expand, the most likely outcome would be further devaluation of the Chinese currency (Yuan), which would in-turn lead to reduced buying power for Chinese investors as well as a reduced ability to pay foreign loans. Further currency devaluation would also cause significant global market volatility.

China does have a large supply of foreign reserves (about USD$3.2 Trillion worth) but that is down from $4 Trillion just last year, and still pales in comparison to the USD$25 Trillion of debt currently owing. It is estimated that China could burn through its foreign reserves in three years if the current pace were to continue. A currency and economic crisis would surely ensue well before reserves are depleted, as investors will see it coming well ahead. In this case, a Chinese bubble may continue but its value would still fall in USD terms.

At some point, the Chinese government may also curb the flight of capital if foreign reserves start to dwindle down to worrying levels or when an economic contraction eventually occurs. This is important because it would curtail a source of capital for real estate markets in North America, Europe and Australia.

‘Free Market’ philosophy is misguided

The irony here is that proponents of free market philosophy who don’t want the Canadian (or Provincial) government to interfere with foreign buying activity do not realize that if the Chinese government operated under free market principles, China’s credit bubble would have contracted years ago, and along with it, Vancouver’s real estate bubble. Instead what we are seeing is government mandated oversupply of debt-fueled money from China with little GDP growth to show for it. Nor is it helping their private sector achieve sustainable growth.

Foreign real estate investment should be restricted

Unaffordable home prices have had negative consequences for young families in BC. Young millennials are either putting off buying homes (and delaying starting families) or getting deeper into debt to try to carve out a living in the region they grew up in.

In many cases, Millennials are only able to afford homes by having their parents take out home equity loans. In other cases, Millennials simply choose to move elsewhere – creating a “brain-drain” effect.

High prices affect all residents. Increasingly large mortgages also lead to high rents and reduces discretionary income for many working-age residents, which reduces consumer spending, and often forces consumers into deeper debt. It also forces the BC economy to be over-reliant on just one sector – real estate. Knowing that credit and real-estate move together and in cycles, the inevitable downturn will make a quick recovery difficult to achieve.

Politicians must look forward from time to time to assess sources of risk to the local and provincial economy, and currently there may be no greater risk than a housing crisis led by a Chinese credit crisis. The financial fallout for local families would be unprecedented.

At the time of writing, we suggested the rational course of action should be to tax foreign ownership as well as to apply an additional tax on empty properties, with funds put towards affordable housing. Similar steps have been taken in Hong Kong and Singapore. A recent announcement by the BC Government has introduced a tax, although it’s efficacy has yet to be determined. Other useful measures may include an income-tax based solution, as well as further scrutiny by the Canada Revenue Agency to investigate and fully tax foreign speculators.