LNG Promises Steeped in Forecast Risk

The government of BC staked a great deal of the province’s future prosperity on its ability to work with the energy industry to harness BC’s natural gas reserves for export to the energy hungry nations of Asia. To further underline the future potential, the government has stated that it would follow in the footsteps of Alberta and Norway by establishing a legacy fund from the forecasted tax revenues that the LNG industry would generate. The government estimates that the fund would total about $100 billion in the next thirty years for the benefit of future generations and make BC debt free. |

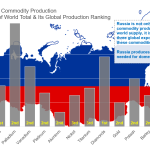

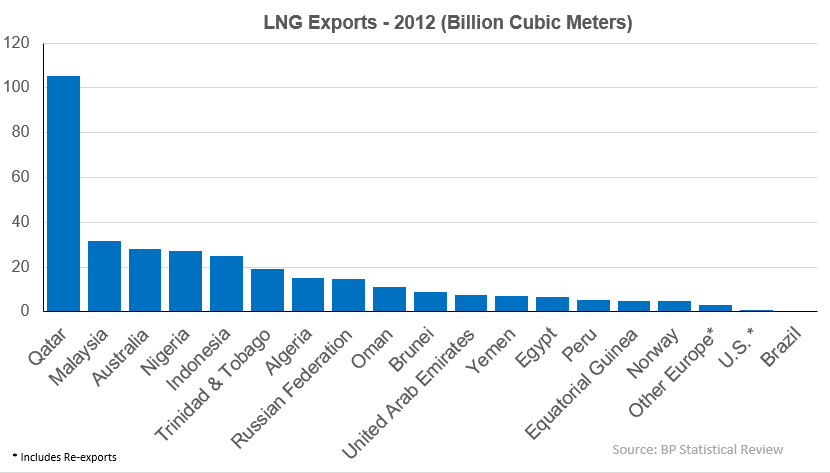

The government of BC staked a great deal of the province’s future prosperity on its ability to work with the energy industry to harness BC’s natural gas reserves for export to the energy hungry nations of Asia. To further underline the future potential, the government has stated that it would follow in the footsteps of Alberta and Norway by establishing a legacy fund from the forecasted tax revenues that the LNG (liquefied natural gas) industry would generate. The government estimates that the fund would total about $100 billion in the next thirty years for the benefit of future generations and make BC debt free. The vision is appealing for obvious reasons and the goal of managing the wealth for future generations is laudable on many facets. What is not so praiseworthy is the fact that this forecast of LNG based wealth & prosperity is based on far too many assumptions that are prone to forecasting risk. This risk is being downplayed and it is worth highlighting where the risks could come from. BC’s own history shows but one example when we look back at the 1961 Columbia River Treaty signed between Canada and the US. The signing of the treaty was one of the last Presidential acts of Dwight Eisenhower and it promised both nations great benefits from dam construction and hydroelectric power generation. However, as a sign of how complicated these things can be – to this day, critics say the Canadian side gave away too much while at the time of negotiation some members of the US Senate were open in their admiration for Canada’s negotiation skills. Critics of this treaty forget the fact that forecasting is often a murky exercise and both sides tried the best they could to get the best deal possible. This is close to where BC stands today as it tries to negotiate the best deal it can with the energy industry. What the future will bring for LNG is most anybody’s guess. Looking back over the last ten years at the rush of investment into the Canadian oil sands might serve to provide a more contemporary example of what can happen in energy markets. France’s Total SA invested billions of dollars in Canadian oil sands assets during the previous decade. However, by last year the company had written down the value of those investments by taking nearly $2 billion in asset writedowns on its investments. Writedowns have also been taken in the US shale gas industry by companies who invested in shale gas acquisitions only to find them uneconomic with the collapse in North American natural gas prices. It is this price weakness that has focused North American energy interests on Asian demand for natural gas since Asian natural gas prices are currently 3 to 4 times higher than those in North America. The Asian nations are wise to this price difference and have been toughening their negotiating stance with natural gas exporters. They know that while Canada and the US would like to try to establish an LNG export industry, countries such as Australia have already begun to ramp up their export capabilities. Australia’s $58 billion Gorgon project (originally budgeted at $37 billion) operated by Chevron and its partners will begin delivering LNG cargo to Asia within the next year. This cost overrun has reduced estimated returns from this project’s original forecasts. This has not gone unnoticed by the companies that are in the process of deciding on whether to proceed with LNG investments in BC. Given the lack of infrastructure already in place in BC, the cost curve is going to be steep and the likelihood of cost overruns is high. That will lead to a strong pushback from the industry on the taxation proposals that the BC government has put forward. A further complication comes from the recent Russia-Chinese LNG agreement. Under this agreement, Russia will provide China with LNG at a price discounted by about 30% from current market rates in Asia and the rates used by the BC government in its study of LNG’s potential. At the same time, competition from other parts of the world is heating up (see chart below). From offshore Africa to the Gulf Coast of the US, LNG is being seen as a lucrative road to riches. Last year saw the discovery of an estimated 13 trillion cubic feet of natural gas reserves off the coast of Mozambique. In the US, there are over 20 projects on the proposal list for the export of natural gas while Congress is looking at the idea of fast tracking the approval process for LNG exports. At the same time, enormous discoveries of natural gas have been found offshore Israel and Iran has stated that it is willing to fill Europe’s supply void should the West decide to put sanctions on the export of Russian natural gas.  While future potential natural gas supply could provide a challenge to pricing estimates of BC LNG exports, another risk comes in the form of demand. It is expected that natural gas will play a key role in Asian energy demand as countries such as China attempt to curtail their use of coal for environmental reasons. However, they are beginning to bristle at the cost of LNG imports. Japan spent about $100 billion on energy imports last year. The bill is starting to sting and the Japanese government seems to be indicating its willingness to look at restarting at least part of its nuclear reactors fleet. As the LNG industry negotiates its tax and regulatory goalposts with the BC government, both sides must remember that projections are just that – projections. Looking at the experiences of Total SA in the Alberta oil sands or Chevron and its partners in the Australian Gorgon LNG project, these are complex projects and seldom does reality meet expectations. Energy markets are dynamic and the sooner both sides are able to reach a consensus, the greater the likelihood that BC will be able to move forward on delivering on the promise of LNG. While future potential natural gas supply could provide a challenge to pricing estimates of BC LNG exports, another risk comes in the form of demand. It is expected that natural gas will play a key role in Asian energy demand as countries such as China attempt to curtail their use of coal for environmental reasons. However, they are beginning to bristle at the cost of LNG imports. Japan spent about $100 billion on energy imports last year. The bill is starting to sting and the Japanese government seems to be indicating its willingness to look at restarting at least part of its nuclear reactors fleet. As the LNG industry negotiates its tax and regulatory goalposts with the BC government, both sides must remember that projections are just that – projections. Looking at the experiences of Total SA in the Alberta oil sands or Chevron and its partners in the Australian Gorgon LNG project, these are complex projects and seldom does reality meet expectations. Energy markets are dynamic and the sooner both sides are able to reach a consensus, the greater the likelihood that BC will be able to move forward on delivering on the promise of LNG.This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information’s accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice. Past performance is not indicative of future performance. Please note that, as at the date of this report, our firm may hold positions in some of the companies mentioned. Social Media: It is Pacifica Partners Inc.’s policy not to respond via online and social media outlets to questions or comments directed to it or in response to its online and social media publications. Pacifica Partners Inc. does not acknowledge or encourage testimonials posted by third party individuals. Third party users that have bookmarked Pacifica Partners Inc.’s social media publications or profile through options including “like”, “follow”, or similar bookmarking variations are not and should not be viewed as endorsement of Pacifica Partners Inc., its services, or future or past investment performance. To view our full disclaimer please click here.Copyright (C) 2014 Pacifica Partners Capital Management Inc. All rights reserved. |